Join Our Groups

TOPIC 1: SUBJECT MATTER OF BOOK KEEPING

Subject Matter of Book Keeping

The Meaning of Book Keeping

Define book keeping

Book-keeping is an art of recording financial business transaction in a set of books in terms of money or money worth.

Bookkeeping involves the recording, storing and retrieving of financial transactions for a company, nonprofit organization and individuals.Prior to computers and software, the bookkeeping for small businesses usually began by writing entries into journals. Journals were defined as the books of original entry. In order to reduce the amount of writing in a general journal, special journals or day books were introduced. The special or specialized journals consisted of a sales journal, purchases journal, cash receipts journal, and cash payments journal.The image below shows purchase which was recorded in a day book. This was before the current development of communication technology.

Common financial transactions and tasks that are involved in bookkeeping include:

- Billing for goods sold or services provided to clients.

- Recording receipts from customers.

- Verifying and recording invoices from suppliers.

- Paying suppliers.

- Processing employees' pay and the related governmental reports.

- Monitoring individualaccounts receivable.

- Recording depreciation and other adjusting entries.

- Providing financial reports.

Today bookkeeping is done with the use of computer software. For example, Quick-books (from Intuit) is a low-cost bookkeeping and accounting software package that is widely used by small businesses.

Bookkeeping requires knowledge of debits and credits and a basic understanding of financial accounting, which includes the balance sheet and income statement. In principle transactions have to be recorded daily into the books or the accounting system

For each transaction, there must be a document that describes the business transaction, in the terms of a simple sales invoice, sales receipt, a supplier invoice, a supplier payment, bank payments and journals.

Double-entry bookkeeping

The double entry system of bookkeeping is based upon the fact that every transaction has two parts and that this will therefore affect two ledger accounts.

Every transaction involves a debit entry in one account and a credit entry in another account. This serves as a kind of error-detection system: if, at any point, the sum of debits does not equal the corresponding sum of credits, then an error has occurred. Business transactions are events that have a monetary impact on the financial statements of an organization.

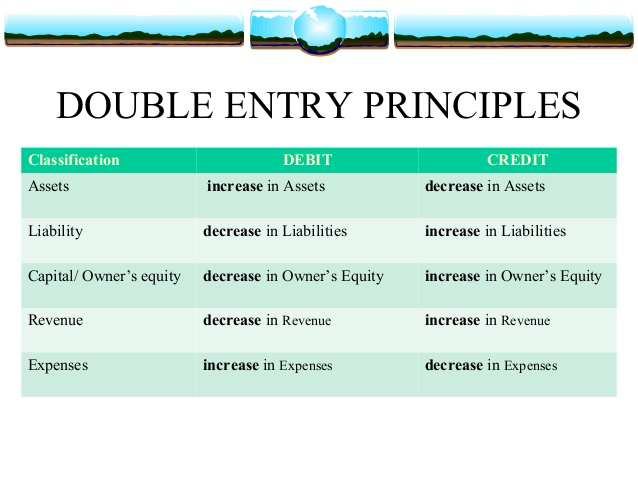

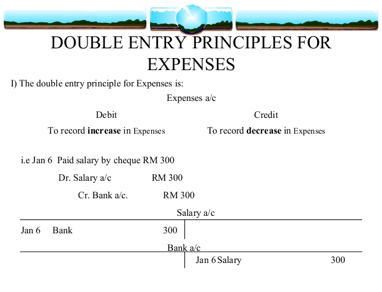

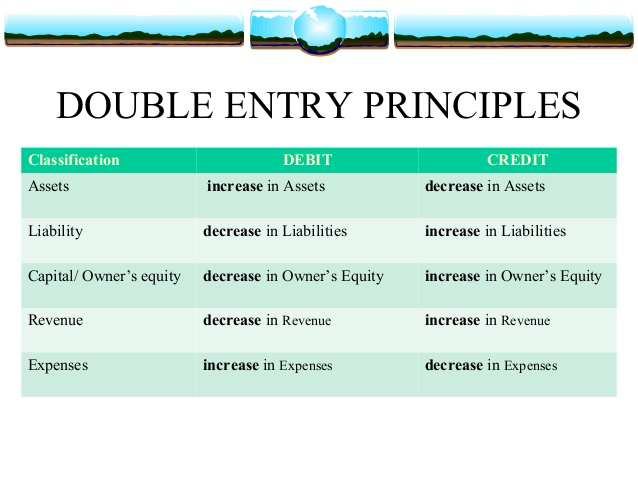

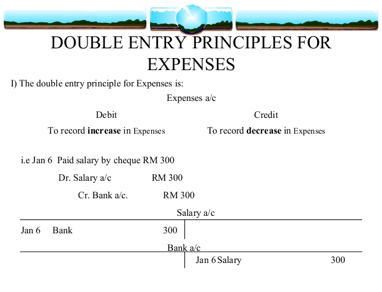

When accounting for these transactions, we record numbers in two accounts, where the debit column is on the left and the credit column is on the right. We always debit and credit financial transaction depending on what account your dealing with. For more information on double entry principle, see the table below.

- Adebitis an accounting entry that either increases an asset or expense account, or decreases a liability or equity account. It is positioned to the left in an accounting entry.

- Acreditis an accounting entry that either increases a liability or equity account, or decreases an asset or expense account. It is positioned to the right in an accounting entry.

The Role of Book Keeping

Explain the role of Book-keeping

There are various objectives of bookkeeping and accounting to different parties i.e the owners, managers, creditors, government, customers etc. The common important objectives of book keeping are:

- Ascertainment of result of operation: Bookkeeping is intended to the ascertainment of the result of operation i.e the profit/loss of a firm or company by recoding all the revenue income and gains and expenses and losses of a certain period and by comparing them. It is ascertained by preparing the income statement or profit and loss account at the end of each fiscal year.

- Ascertainment of the financial position: It helps to ascertain the financial position of a firm or company by recording the appropriate values of different types of assets, specially in its net cost, and the capital and liabilities up to the date. It is found by preparing the balance sheet at the close of the fiscal year.

- Maintaining control over the assets and budget: Bookkeeping maintains control on the assets, income and expenses of all types by making their complete records. It helps one to see how efficiently the assets are utilized and the budget is disposed off. Thus, it establishes financial discipline by controlling frauds on budget and its expenditure.

- Prediction of the volume of cash for future: Bookkeeping helps the future forecast of cast by verifying the receipt and payments of an organization and the proposed expansion programmes. Specially, it is important to those whole financial system is based upon cash budget

Assessment of tax liabilities

Book keeping keeps the complete records of all business transactions and get them audited. Book keeping involves the income statement and balance sheet at the last of the fiscal year. It gives the details about the financial affairs of an organization, including the sales and net income on the basis of which tax liabilities i.e sales tax, income tax etc. can be easily assessed.

Importance and advantages of Bookkeeping

Book keeping is important to all, who are engaged in any sort of occupation and rather important to the organization for ascertaining the true state of the organization's affairs. The importance of book keeping may be studied with respect to the different sectors.

- Importance to the professional and other individuals: Book keeping is important to the professionals like doctors, engineer, mechanics, lawyer, auditor etc. for recording their incomes and expenses and profits and losses etc. regularly and systematically for controlling expenses and gaining income. Similarly, it is important to the general people for making a proper balance of their income and expenses for their personal house hold affairs.

- Important to business organizations: Book keeping is essentially important to a business organization for keeping the complete records of the transactions. It is important, specially to determine the result of operation, financial position, controlling assets and other resources, establishing financial discipline, assessing tax liabilities etc.

- Importance to the government: Book keeping is important to the government to evaluate the progress of the government projects, to collect necessary statements, data and information for the preparation of government budget, to control over the leakage, misuse and misappropriation of budget etc. of the government property and resources.

- Important to other parties: Book keeping is equally important to the financial analysts and other interested parties like investors, creditors, banks, customers etc. to study and analyze the different financial statements of a certain firm or company. It is also important to the job seekers for better opportunity for getting employment.

The Concept of Double Entry

Explain the concepts of business entity

Every transaction has two effects. For example, if someone transacts a purchase of a drink from a local store, he pays cash to the shopkeeper and in return, he gets a bottle of dink. This simple transaction has two effects from the perspective of both, the buyer as well as the seller. The buyer's cash balance would decrease by the amount of the cost of purchase while on the other hand he will acquire a bottle of drink. Conversely, the seller will be one drink short though his cash balance would increase by the price of the drink.

Accounting attempts to record both effects of a transaction or event on the entity's financial statements. This is the application of double entry concept. Without applying double entry concept, accounting records would only reflect a partial view of the company's affairs. Imagine if an entity purchased a machine during a year, but the accounting records do not show whether the machine was purchased for cash or on credit. Perhaps the machine was bought in exchange of another machine. Such information can only be gained from accounting records if both effects of a transaction are accounted for.

Traditionally, the two effects of an accounting entry are known as Debit (Dr) and Credit (Cr). Accounting system is based on the principal that for every Debit entry, there will always be an equal Credit entry. This is known as the Duality Principal.

Debit entries are ones that account for the following effects:

- Increase in assets

- Increase in expense

- Decrease in liability

- Decrease in equity

- Decrease in income

Credit entries are ones that account for the following effects:

- Decrease in assets

- Decrease in expense

- Increase in liability

- Increase in equity

- Increase in income

Double Entry is recorded in a manner that the Accounting Equation is always in balance.

Assets - Liabilities = Capital

Any increase in expense (Dr) will be offset by a decrease in assets (Cr) or increase in liability or equity (Cr) and vice-versa. Hence, the accounting equation will still be in equilibrium.

LEDGER: Is a main book of account. Used to record all transaction in a systematic way or

A ledger is a complete record of financial transactions over the life of a company. The ledger holds account information that is needed to prepare financial statements, and includes accounts for assets, liabilities, owners' equity, revenues and expenses.

A general ledger is a complete record of financial transactions over the life of a company. The ledger holds account information that is needed to prepare financial statements, and includes accounts for assets, liabilities, owners' equity, revenues and expenses.

Posting is when the balances in sub ledgers and the general journal are shifted into the general ledger. Posting only transfers the total balance in a sub ledger into the general ledger, not the individual transactions in the sub ledger. An accounting manager may elect to engage in posting relatively infrequently, such as once a month, or perhaps as frequently as once a day

AN ACCOUNT: is a record in the general ledger that is used to collect and store debit and credit amounts. For example, a company will have a Cash account in which every transaction involving cash is recorded. If the company sells merchandise for cash, the Cash account will be debited and the Sales account will be credited.

Another definition of an account is a record of a customer relationship. For example, if a company sells merchandise to a customer on credit, there seller will have an account receivable and the purchaser will have an account payable.

The term on account means not for cash. For example, if a company purchases merchandise with the terms net 30 days, it means the company has 30 days in which to pay.

An account has two sides:

- DEBIT SIDE-is the left side of an account

- CREDIT SIDE-is the rightside of an account.

Exercise 1

Read carefully at the following sentences, decide whether it is true or false. Remember to refer to the notes

- Double entry involve two entries_______

- Debit side is on the right side of double entry account _____

- When using double account, you must always ignore the way banks treat their debit and credits _____.

- In double entry accounting, every transaction is recorded twice. _____.

- Example of payment into bank account is wages. _____

Your work is greatly appreciated because it has easen the hectical struggle for students who study business as well as for teachers who are facilitating the subject. Keep up the good work.

返信削除