Join Our Groups

TOPIC 11: INCOMPLETE RECORDS

Incomplete Records

Statements Showing Profit or Loss From Incomplete Records

Draw up statements to show profit or loss from incomplete records

Some times, businesses, especially small businesses do not maintain a full set of double entry records. Consequently, no trial balance will be produced and a complete set of final accounts cannot be prepared without further analysis of the records that do exist.

Where only records available are the assets and liabilities at the beginning of the year and at the end of the year, it is not possible to prepare a Trading and Profit and Loss account. The assets and liabilities are usually listed in a Statement of Affairs (Similar to a Balance Sheet). This would have been called a Balance Sheet if it had been drawn up from a set of double entry records. Like a Balance Sheet, a Statement of Affairs can be prepared horizontally or vertically.

The only way the profit for the year can be found is by comparing the capital shown in the opening Statement of Affairs with the capital shown in the closing Statement of Affairs.The basic formula is:

Profit Loss = Closing Capital – Opening Capital (Positive figure means Profit and Negative figure means Loss)

It may be that the owner has made drawings during the year, which will account for some of the difference in the capital figures. Similarly the owner might have brought in additional capital during the year, which will also account for some of the difference in the capital figures. In this case the formula must again be modified:-

Profit or Loss = Closing Capital + Drawings during the year – Additional Capital during the year – Opening Capital (Positive figure means Profit and Negative figure means Loss)

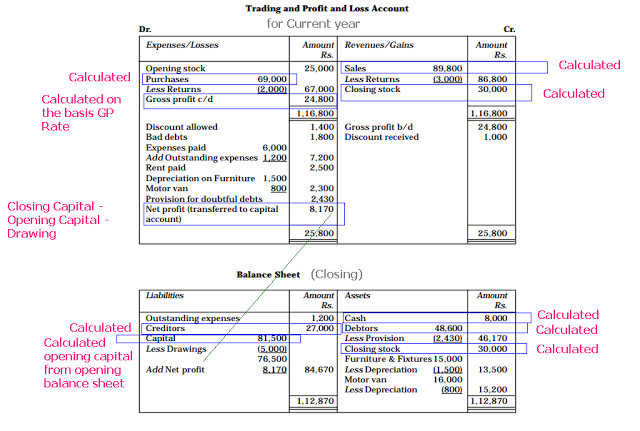

Calculation of Profit or Loss by converting the Incomplete Records into Double entry Records,

In this case, in order to calculate the profit or loss of the business during the year, the Trading and Profit and Loss accounts are prepared. For preparing the Trading and Profit and Loss accounts, all necessary information is not available in the books. So first the missing items have to be calculated which are necessary for the preparation of Trading and Profit and Loss accounts.

Example 1

Trading, Profit and Loss Account

Prepare trading, profit and loss account

Example 2

From the following balances extracted from the books of X & Co, prepare a trading and profit and loss account on 31st December, 1991.

| $ | $ | ||

| Stock on 1st January | 11,000 | Returns outwards | 500 |

| Bills receivables | 4,500 | Trade expenses | 200 |

| Purchases | 39,000 | Office fixtures | 1,000 |

| Wages | 2,800 | Cash in hand | 500 |

| Insurance | 700 | Cash at bank | 4,750 |

| Sundry debtors | 30,000 | Tent and taxes | 1,100 |

| Carriage inwards | 800 | Carriage outwards | 1,450 |

| Commission (Dr.) | 800 | Sales | 60,000 |

| Interest on capital | 700 | Bills payable | 3,000 |

| Stationary | 450 | Creditors | 19,650 |

| Returns inwards | 1,300 | Capital | 17,900 |

The stock on 21st December, 1991 was valued at $25,000.

Solution

X & Co.Trading and Profit and Loss Account For the year ended 31st December, 1991

| To Opening stock | 11,000 | | | By Sales | 60,000 | ||

| To Purchases | 39,000 | | | Less returns i/w | 1,300 | ||

| Less returns o/w | 500 | | | 58,700 | |||

| 38,500 | | | By Closing stock | 25,000 | |||

| To Carriage inwards | 800 | | | ||||

| To Wages | 2,800 | | | ||||

| To Gross profit c/d | 30,600 | | | ||||

| | | ||||||

| 83,700 | | | 83,700 | ||||

| | | ||||||

| To Stationary | 450 | | | By Gross profit b/d | 30,600 | ||

| To Rent and rates | 1,100 | | | ||||

| To Carriage outwards | 1,450 | | | ||||

| To Insurance | 700 | | | ||||

| To Trade expenses | 200 | | | ||||

| To Commission | 800 | | | ||||

| To Interest on capital | 700 | | | ||||

| To Net profit transferred to capital a/c | 25,200 | | | ||||

| | | ||||||

| | | ||||||

| 30,600 | | | 30,600 | ||||

Preparation of Balance Sheet

Prepare balance sheet

Example 3

From the following balances extracted from the books of X & Co, prepare a balance sheet on 31st December, 1991.

| $ | $ | ||

| Stock on 1st January | 11,000 | Returns outwards | 500 |

| Bills receivables | 4,500 | Trade expenses | 200 |

| Purchases | 39,000 | Office fixtures | 1,000 |

| Wages | 2,800 | Cash in hand | 500 |

| Insurance | 700 | Cash at bank | 4,750 |

| Sundry debtors | 30,000 | Tent and taxes | 1,100 |

| Carriage inwards | 800 | Carriage outwards | 1,450 |

| Commission (Dr.) | 800 | Sales | 60,000 |

| Interest on capital | 700 | Bills payable | 3,000 |

| Stationary | 450 | Creditors | 19,650 |

| Returns inwards | 1,300 | Capital | 17,900 |

The stock on 21st December, 1991 was valued at $25,000.

Solution

X & Co. Balance Sheet as at 31st December, 1991

| Liabilities | $ | | | Assets | $ | |

| Creditors | 19,650 | | | Cash in hand | 500 | |

| Bills payable | 3,000 | | | Cash at bank | 4,750 | |

| Capital | 17,900 | | | Sundry debtors | 30,000 | |

| Add Net profit | 25,200 | | | Bill receivable | 4,500 | |

| 43,100 | | | Stock | 25,000 | ||

| | | Office equipment | 1,000 | |||

| | | |||||

| 65,750 | | | 65,750 | |||

| | | |||||

Calculating Amount of Cash Stolen

Calculate amount of cash stolen

The loss on theft of cash and any other assets may be simply be expensed to the income statement net of any insurance claim received or receivable. Following accounting entries would therefore be required:

| Debit | Loss on asset theft (balancing amount) |

| Debit | Accumulated Depreciation |

| Credit | Asset (carrying amount) |

EmoticonEmoticon