TOPIC 5: DEPRECIATION

Depreciation

If an asset id used for more than one year, it should be capitalized. Assets accounts names such as Vehicles, Office equipment or Buildings. at the end of each accounting period, depreciation for the period is debited to the depreciation expense. Accumulated Depreciation shows all depreciation that has been taken during the asset’s file.

Cost of a Fixed Asset

Determine the cost of a fixed asset

Depreciation is the systematic reduction in the recorded cost of a fixed asset. Examples of fixed assets that can be depreciated are buildings, furniture, leasehold improvements, and office equipment. The only exception is land, which is not depreciated (since land is not depleted over time, with the exception of natural resources).

An Asset Account

Write up an asset account

Accounts maintained on fixed assets are called Asset Accounts. In other words, assets accounting deal with fixed assets by providing detailed information on transactions. It deals with fixed assets from the date of acquisition to the date of retirement or sale. Assets accounts include depreciation, partial sale of asset and appreciation.

Difference between Capital and Revenue Expenditure

Distinguish between copula and revenue expenditure

Capital expenditures represent major investments of capital that a company makes to maintain or, more often, to expand its business and generate additional profits. Capital expenses are for the acquisition oflong-term assets, such as facilities or manufacturing equipment. Because such assets provide income-generating value for a company for a period of years, companies are not allowed to deduct the full cost of the asset in the year the expense is incurred; they must recover the cost through year-by-yeardepreciationover theuseful lifeof the asset. Companies often usedebt financingorequity financingto cover the substantial costs involved in acquiring major assets for expanding their business.

Revenue expenses are shorter-term expenses required to meet the ongoing operational costs of running a business, and thus are essentially the same as operating expenses. Unlike capital expenditures, revenue expenses can be fully tax-deducted in the same year the expenses occur. In relation to the major asset purchases that qualify as capital expenditures, revenue expenditures include the ordinary repair and maintenance costs that are necessary to keep the asset in working order without substantially improving or extending the useful life of the asset. Revenue expenses related to existing assets include repairs and regular maintenance as well as repainting and renewal expenses. Revenue expenditures can be considered to be recurring expenses in contrast to the one-off nature of most capital expenditures.

The purpose of capital expenditures is commonly to expand a company’s ability to generate earnings, whereas revenue expenditures are more commonly for the purpose of maintaining a company’s ability to operate. Capital expenditures appear as an asseton a company’s balance sheet; revenue expenses are listed with liabilities.

Relationship between Depreciation and the Matching Principle

Explain the relationship between depreciation and the matching principle

The reason for using depreciation is to match a portion of the cost of a fixed asset to the revenue that it generates; this is mandated under the matching principle, where you record revenues with their associated expenses in the same reporting period in order to give a complete picture of the results of a revenue-generating transaction. The net effect of depreciation is a gradual decline in the reported carrying amount of fixed assets on the balance sheet. It is very difficult to directly link a fixed asset with a revenue-generating activity, so we do not try – instead, we incur a steady amount of depreciation over the useful life of each fixed asset, so that the remaining cost of the asset on the company’s records at the end of its useful life is only its salvage value.

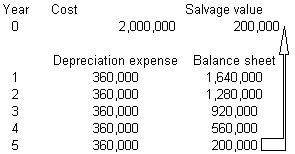

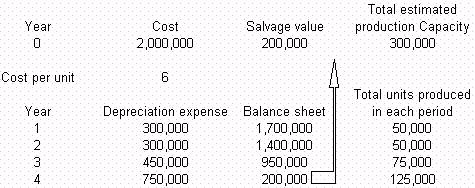

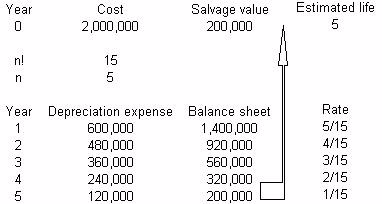

Computing Depreciation